Let’s be honest for a second. We Indians don’t just buy gold because it glitters. We buy it because it lets us sleep better at night.

I remember my grandmother telling me, “Stocks will crash, land can be disputed, but gold? Gold is your silent bodyguard.” She wasn’t wrong. In a world where inflation eats our savings and market volatility is the new normal, gold remains the one asset that has held its ground for 5,000 years.

If you walk into a showroom and buy a heavy, intricate bridal necklace studded with uncut diamonds (Polki), you might think you are investing. But the moment you walk out that door, the value of that piece could drop by 30%. That’s not an investment; that’s an expense.

To truly Future-Proof Your Portfolio, you need to stop shopping like a consumer and start thinking like an investor. You need a strategy.

In this guide, I am going to share the exact Latest Gold Jewellery Investment Strategy that I use personally. We will decode the math of making charges, the trap of gemstones, and the specific wearable designs that act like “Bullion on your Body.”

Read more: Contemporary Gold Jewellery

The “Investment-Grade” Mindset: Usage vs. Returns

The first step is to categorize your purchase. Are you buying this to look like a queen at your brother’s wedding? Or are you buying this to sell in 10 years for a profit?

- Vanity Purchase: High fashion, intricate work, high making charges. (Low ROI).

- Investment Purchase: Simple designs, high purity, low making charges. (High ROI).

You can have both, but you need to know the rules. The goal of this guide is to help you buy jewelry that you can enjoy wearing today while ensuring it fetches you maximum cash tomorrow.

Strategy #1: The “12% Rule” (Making Charges)

This is where 90% of investors lose money. When you buy jewelry, you pay: Gold Price + Making Charges (Majuri) + GST. When you sell jewelry, you get: Gold Price only.

Making charges are a “sunk cost.” You never get them back.

- The Trap: Antique, Temple, and intricate Calcutta designs often have making charges ranging from 20% to 35%. If you buy a necklace for ₹1 Lakh with 25% making charges, you have effectively lost ₹25,000 immediately. Gold prices have to rise by 25% just for you to break even!

- The Strategy: Stick to the 12% Rule. For investment pieces, never pay more than 12% in making charges.

- What to Buy:

- Machine-cut chains (8-10% charges).

- Solid plain bangles (8-12% charges).

- Gold coins/bars (2-3% charges).

Pro Tip:

Negotiate the “Wastage” Jewelers often add a “Wastage” charge on top of making charges, claiming gold is lost during polishing. In the age of modern machinery, wastage is minimal. Always negotiate. If a jeweler quotes 18% making charges, ask for a flat discount. Many brands will drop it to 12-14% to close a sale, especially if you are paying by card or bank transfer (white money).

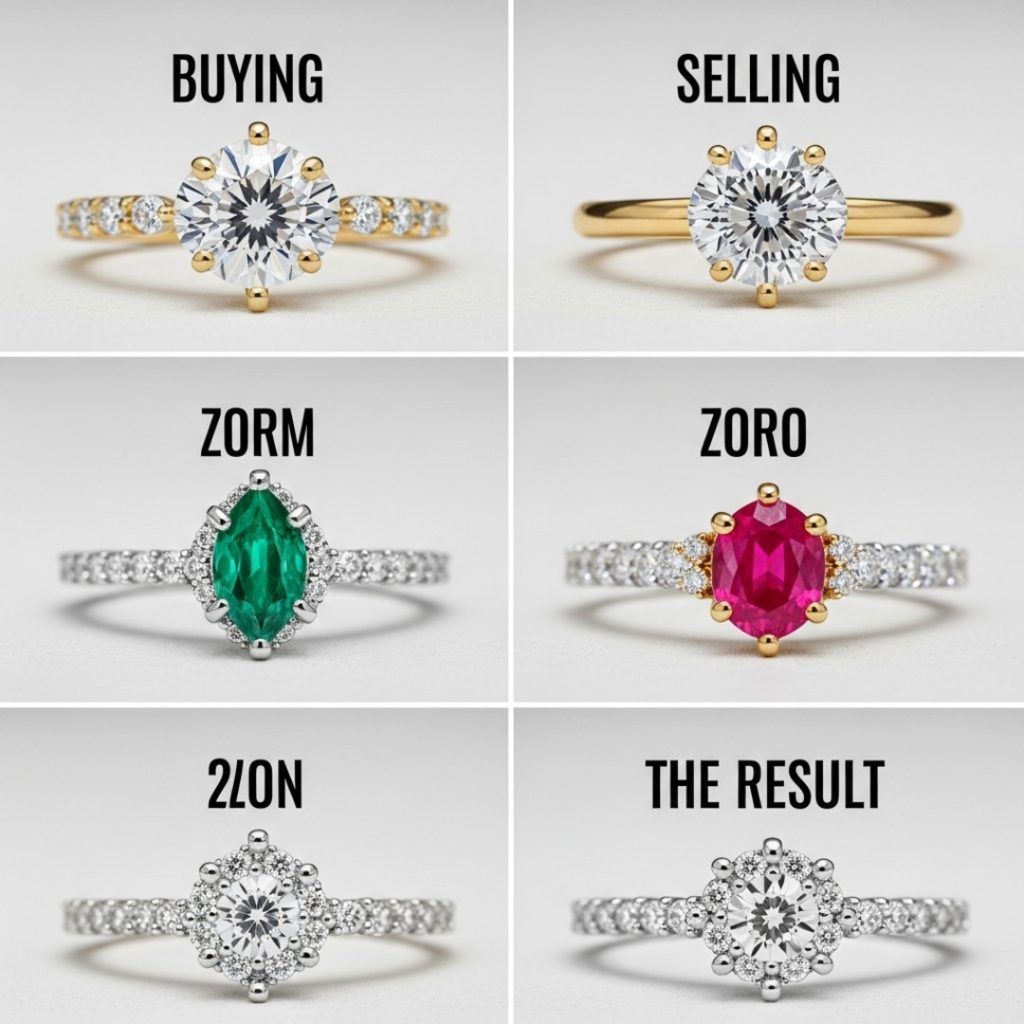

Strategy #2: The “No-Stone” Policy

I love diamonds. They are beautiful. But they are wealth killers in a gold portfolio. Here is the math:

- Buying: You pay for the gold weight + the stone cost + high labor for setting the stone.

- Selling: The jeweler melts the gold. They remove the stones. They deduct the stone weight.

- The Result: You get paid Zero for semi-precious stones (rubies, emeralds, zircon). Even for diamonds, unless they are high-grade solitaires with GIA certificates, the “buy-back” value is often only 70-80% of what you paid.

The Golden Rule: If you want ROI, buy Plain Gold. If you crave color, buy plain gold jewelry with Enamel (Meenakari) work. It adds vibrancy without adding heavy stone weight that gets deducted later.

[Link to related post: Plain Gold vs. Diamond Jewellery: Which Gives Better Returns?]

Strategy #3: The “Wearable Bullion” Designs

You want to invest, but you also want to wear your wealth. You don’t want a locker full of boring coins. Here are the best hybrid designs that act as Future-Proof assets:

1. The Coin Necklace (Kasulaperu)

This is a genius design.

- Why: It is made of 22k or 24k gold coins strung together. Coins have the lowest making charges in the market.

- Liquidity: If you need emergency cash, you can break off one coin and sell it without destroying the whole necklace. It is modular wealth.

2. Solid Gold “Kadas” (Bangles)

- Why: A solid bangle is dense. You can store 50 grams of gold on one wrist. Because the shape is simple, the labor cost is low.

- Durability: Unlike delicate chains that snap and need soldering (lowering purity), a solid bangle lasts forever with zero maintenance.

3. The Gold Biscuit Pendant

- Why: Buy a 5g or 10g pure gold bar (24k). Buy a simple, detachable gold frame (bezel). Wear the bar as a pendant.

- ROI: You are wearing 99.9% pure investment-grade gold with almost zero manufacturing loss. It looks cool, modern, and financially savvy.

Strategy #4: Hallmarking is Your Safety Net

In 2025, buying non-hallmarked gold is financial suicide. The Bureau of Indian Standards (BIS) has made HUID (Hallmark Unique Identification) mandatory.

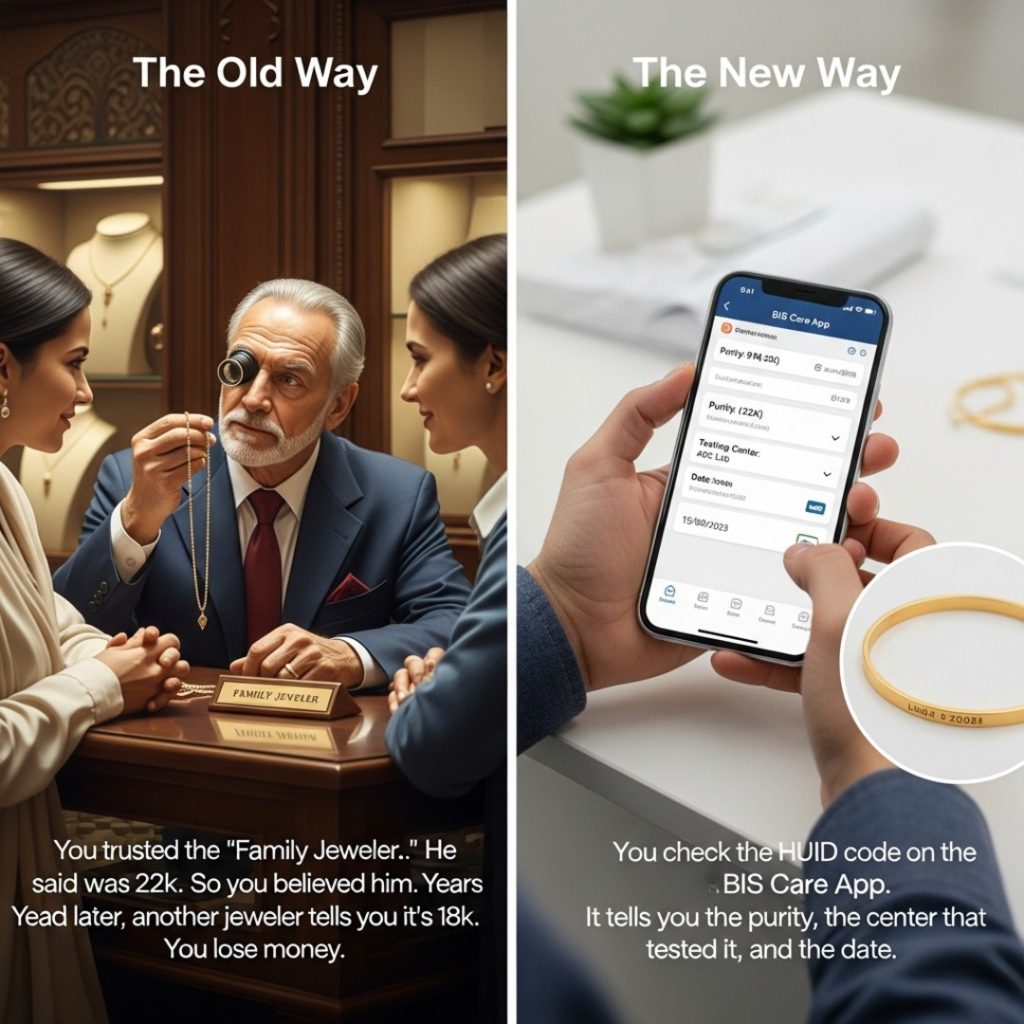

- The Old Way: You trusted the “Family Jeweler.” He said it was 22k, so you believed him. Years later, another jeweler tells you it’s 18k. You lose money.

- The New Way: You check the HUID code on the BIS Care App. It tells you the purity, the center that tested it, and the date.

- The Benefit: HUID gold guarantees Resale Value. You can walk into any jewelry store in India—from Tanishq in Mumbai to a local shop in Kerala—and they must give you the current market rate for 22k. No questions asked. No “melting to check.”

Strategy #5: Timing the Market (SIPs and Dips)

“When is the best time to buy?” The answer is NOT “Dhanteras.” During festivals, demand spikes, and jewelers hike their making charges because they know people will buy anyway.

The “Buy on Dips” Strategy: Gold prices fluctuate based on the US Dollar and global tensions.

- Install a gold price tracking app.

- When you see a drop of ₹1,000 or ₹2,000 per 10g (which happens a few times a year), BUY.

- Even if you don’t need jewelry now, buy a Gold Coin on the dip. Later, when you want a necklace, exchange the coin. You have effectively locked in the gold rate at a low price.

The Gold SIP (Monthly Scheme): If you aren’t good at saving, use a Jeweler’s Purchase Plan (like Tanishq’s Golden Harvest or similar).

- You pay ₹5,000/month for 10 months.

- The jeweler pays the 11th installment (or gives a heavy discount on making charges).

- Benefit: The return on investment here is effectively huge (sometimes 50-60% annual return on your money via the discount) because you save the making charges.

Strategy #6: Digital vs. Physical (The Hybrid Portfolio)

A truly future-proof portfolio isn’t 100% physical jewelry.

- Physical Jewellery (50%): For usage, weddings, and emergency liquidity at home.

- Sovereign Gold Bonds (SGB) (30%): Issued by the Govt of India. You get 2.5% interest every year plus the gold price appreciation. No making charges, no storage risk, and tax-free at maturity.

- Gold ETFs/Digital Gold (20%): For short-term trading or small savings (you can buy for ₹100).

The Verdict: Jewelry gives you emotional returns. SGB gives you financial returns. You need both.

Conclusion: The “Grandmother” Test

When in doubt, apply the “Grandmother Test.” Look at the piece of jewelry you are about to buy.

- Is it heavy and solid?

- Is it mostly gold and not stones?

- Will it look just as valuable in 20 years as it does today?

If the answer is yes, buy it.Future-Proofing Your Portfolio isn’t about predicting the exact price of gold in 2030. It is about ensuring that whatever you buy retains its purity and weight. It is about minimizing the “leakage” of money through making charges and stones.

So, the next time you walk into a showroom, ignore the spotlight on the diamond necklace. Walk to the plain gold counter. Pick up that solid bangle. Feel its weight. That isn’t just jewelry. That is your future, secured in 22 karats.

I’d love to hear your strategy: Do you prefer buying gold coins for investment, or do you believe in buying jewelry you can wear? Let me know in the comments below!

Frequently Asked Questions (FAQs)

Is it better to buy 22k or 24k gold for investment?

For Jewellery, 22k (916 purity) is the best choice. 24k is too soft to hold shape and will bend easily. For Coins/Bars, 24k (999 purity) is the best choice because you get the purest gold with the lowest making charges.

Does old gold lose value over time?

No, gold never loses value. In fact, it appreciates. However, if your old gold was bought without a Hallmark, you might lose some value during the exchange because the jeweler will melt it to check purity. If it turns out to be 20k instead of 22k, you will get less money. This is why buying Hallmarked gold today is essential.

What are the making charges for a gold coin?

Gold coins have the lowest making charges, typically ranging from 2% to 4%. Some banks sell coins with higher premiums (packaging/branding costs), so it is often cheaper to buy coins from a reputable jeweler than from a bank.

Can I sell gold jewelry for cash?

Yes, you can sell gold for cash, but there are limits. In India, for large amounts, jewelers prefer bank transfers or cheques to maintain KYC records. Most jewelers will deduct around 2-3% as a “melting/handling charge” when you sell cash-for-gold, whereas “Exchange” (old for new) usually gets you 100% value.

Are “Gold Saving Schemes” (SIPs) safe?

Generally, yes, if done with big, reputed brands (like Tanishq, Malabar, Kalyan, etc.). They are highly beneficial because the discount at the end effectively covers the making charges of your purchase. However, avoid unregulated schemes from small, local jewelers without proper receipts.