We Indian women have a unique superpower. We can look at a piece of jewelry and instantly calculate its value—not just in rupees, but in memories, prestige, and future security.

But let’s be honest. How many times have you bought a stunning necklace, only to be heartbroken years later when a jeweler tells you, “Madam, this has too many stones and high making charges; I can only give you 70% of what you paid”?.

When we talk about gold, we often confuse “expensive” with “valuable.” A heavy, intricate bridal set might be expensive, but it is often a poor investment. A simple, solid gold bangle, on the other hand, is a financial powerhouse.

If you are looking to build a jewelry collection that doubles as a safety net, you need to stop shopping like a consumer and start shopping like an investor.

In this guide, I’m going to share the secrets of buying Exclusive 22K Gold Jewellery Designs that retain the highest resale value. These are pieces you can wear with pride today and sell for a profit tomorrow.

Read more: Trending Gold Jewellery

The Golden Rule of Resale: Understanding “Deductions”

Before we look at designs, you must understand why money is lost during resale. When you sell old jewelry, the jeweler deducts two things:

- Making Charges: The labor cost you paid to create the design. This is never returned.

- Stone Weight: If your 20g necklace has 2g of rubies, you get paid for only 18g of gold.

The Strategy: To get the Highest Resale Value, you need designs with low making charges (machine-made or simple) and zero stones.

Top 5 High-Resale 22K Gold Designs for 2025

Here are the specific styles that are trending in 2025 and are technically “investment-grade” wearables.

1. The “Thos” (Solid) Gold Bangle

If I could recommend only one piece of jewelry to every woman, it would be a pair of solid gold bangles.

- The Design: Look for “Pipe Kadas” or plain semi-round bangles with a smooth finish. Avoid intricate filigree or cuts.

- Why it has High Resale Value: Solid bangles are dense. They have very little air or wax inside (unlike lac-filled bangles). They are virtually indestructible.

- Investment Rating: 9.5/10. Making charges are typically low (8% – 12%), and they fetch 100% of the gold weight value upon sale.

2. The Geometric “Laser-Cut” Pendant

Modern technology has given us a gift: Laser cutting.

- The Design: Sharp, geometric shapes—hexagons, triangles, or bars—that are cut by precision lasers. They look extremely modern and chic for office wear.

- Why it has High Resale Value: Because these are machine-made, the labor cost is minimal compared to hand-carved antique pieces. You pay for the gold, not the labor.

- Style Tip: Wear a 5g geometric pendant on a thin chain for a minimalist “CEO look.”

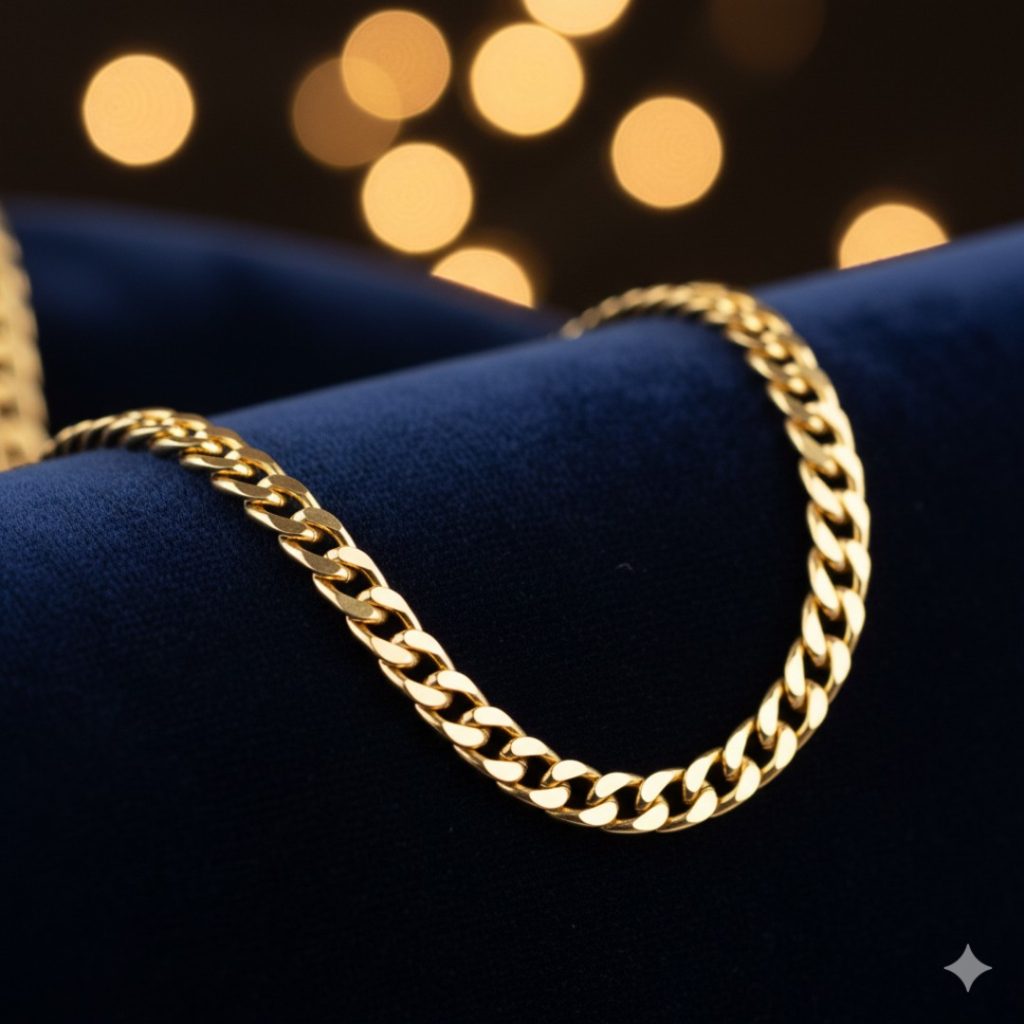

3. The Classic “Gourmette” or Curb Chain

Chains are liquid cash. But not all chains are equal.

- The Design: Avoid hollow “rope” chains that snap easily. Go for the Gourmette (Curb) or Figaro links. These are flat, interlocking links that lie smooth against the skin.

- Why it has High Resale Value: These are standard designs recognized globally. They are easy to melt and recycle, meaning jewelers accept them instantly without deducting for “solder impurities.”

- The 2025 Trend: “Paperclip” link chains are huge right now. They are stylish yet simple enough to be a smart buy.

4. Gold “Biscuits” in Pendant Frames

This is my favorite hack for smart investors.

- The Design: Instead of buying a design, buy a 5g or 10g Gold Coin/Bar (which has near-zero making charges). Then, buy a simple, lightweight “bezel” frame to hold it.

- Why it has High Resale Value: You are essentially wearing bullion. When you want to sell, you just pop the coin out. You lose nothing on the coin, and only a tiny fraction on the frame.

- The Look: It gives a vintage, Roman-coin aesthetic that is very fashionable.

5. Plain Gold Jhumkas (No Stones)

Jhumkas are timeless, but the stone-studded ones are wealth killers.

- The Design: Look for “Matte Finish” Plain Gold Jhumkas. The texture gives them a rich, antique look without needing rubies or emeralds to enhance them.

- Why it has High Resale Value: You are paying only for 22k gold. No stones to be deducted. Plus, matte finish hides scratches better than glossy gold, keeping them looking new for longer.

What to AVOID: The “Resale Killers”

If you want your jewelry to act as an investment, stay away from these traps:

- Enamel (Meenakari) Heavy Pieces: While beautiful, enamel is technically glass powder. When you sell, the jeweler will deduct the weight of the enamel, often estimating it higher than it actually is.

- Kundan & Polki: This is the biggest trap. In Polki sets, up to 40% of the weight can be the “lac” (wax) used to set the stones. You pay for gold but get a lot of wax. Buy these for luxury, not investment.

- Rose Gold with High Copper: While trendy, some local jewelers try to deduct extra for rose gold, claiming it has higher copper content (even if it’s 22k). Stick to Yellow Gold for the easiest resale.

The “HUID” Factor: Your Safety Net

In 2025, buying non-hallmarked gold is like burning money. Always ensure your piece has the HUID (Hallmark Unique Identification) code.

- Why? When you go to sell a non-hallmarked piece, the jeweler will melt it to check purity. You lose the design and often discover it was only 18k or 20k.

- With HUID: You don’t need to melt it. The code proves it is 22k. You get the current market rate instantly.

Smart Buying Strategy for 2025

- Buy on “Dips”: Don’t buy on Akshaya Tritiya when prices are hiked. Buy when the market is quiet.

- Negotiate Making Charges: If you are buying a plain chain, never accept the first price. Making charges are highly negotiable. Ask for a 20-30% discount on the labor cost.

- Keep the Bill: It sounds obvious, but having the original tax invoice often helps you get a better exchange rate from the same jeweler later.

Conclusion: Wear Your Wealth

The best investment is one that you enjoy. A gold biscuit sitting in a dark locker is safe, but a gold bangle on your wrist is empowering.

By choosing High Resale Value designs—plain, solid, and machine-cut—you are respecting your hard-earned money. You are telling the world that you have style, but you also have brains.

So, the next time you walk into a showroom, ignore the glittering stones. Walk straight to the plain gold counter. That is where the real treasure lies.

I’d love to hear your thoughts: Do you prefer wearing plain gold or do you love the sparkle of stones despite the lower resale value? Let me know in the comments below!

Frequently Asked Questions (FAQs)

Which type of gold jewelry has the highest resale value?

Plain 22K Gold Bullion Jewelry (like solid bangles, chains, and coins) has the highest resale value. This is because they have minimal making charges (8-12%) and no stones, meaning you get paid for nearly 100% of the gold weight at current market rates.

Does 22K gold have better resale value than 18K?

Yes, absolutely. 22K gold is 91.6% pure, making it the standard for investment-grade jewelry in India. 18K is only 75% gold. While 18K is good for diamond durability, 22K fetches a much higher price per gram when sold or exchanged.

Do jewelers deduct money for stones when buying back gold?

Yes. Jewelers will deduct the weight of any stones (precious or semi-precious) and enamel from the total weight. Furthermore, they usually do not pay you for the stones themselves unless they are high-value certified diamonds. This is why plain gold is better for investment.

How can I avoid losing money on making charges?

You cannot avoid them entirely, but you can minimize them.

Choose Machine-Made designs (chains, bangles) which have lower making charges (8-12%) compared to hand-crafted antique pieces (20-30%).

Negotiate with the jeweler for a discount on making charges.

Buy during “Zero Making Charge” offers that big brands run occasionally.

Is HUID mandatory for selling gold?

While you can sell non-hallmarked gold, you will likely get a lower rate because the jeweler will have to melt it to verify purity. Having HUID (Hallmark Unique Identification) ensures you get the full market value for 22K purity without any destructive testing.