You know that specific feeling when you walk into a jewelry store? The lights are bright, the velvet trays are soft, and everything glitters. It is magical. But then, the calculator comes out, and suddenly, the magic feels a bit like stress.

I remember when I bought my first gold chain with my own salary. I was so excited about the design that I didn’t ask a single question about the purity or the making charges. Years later, when I went to exchange it for a pair of bangles, I was shocked. The jeweler told me it wasn’t 22k as promised, but 18k. I lost money that day, but I gained a lesson that I am going to share with you now.

We Indian women don’t just buy gold to look pretty at weddings. We buy it as a safety net. It is our “Stree Dhan.”

But here is the big question: Can buying beautiful jewelry actually be a Smart Gold Investment?

The short answer is: Yes. But only if you buy it with your brain, not just your heart. In this guide, I am going to break down everything—from understanding those tiny hallmark stamps to knowing which designs give you the best returns. Grab a cup of chai, and let’s talk gold.

Why Gold Is More Than Just Metal

Before we get into the technical stuff, let’s talk about why we are even doing this. In India, gold isn’t just an accessory; it is a currency.

When the stock market crashes or property prices get stuck, gold usually keeps going up. It is what financial experts call a “hedge against inflation.” But for us, it is simpler: Gold is instant cash. You can’t sell a piece of land in one hour during an emergency, but you can sell a gold bangle in 10 minutes anywhere in the country.

However, not all gold jewelry is created equal. Buying a heavy, stone-studded necklace is very different from buying a solid gold biscuit or a plain chain. If you want your jewelry to act like an investment, you need to understand the rules of the game.

Read more: Signature Latest Gold Jewellery

Rule #1: The Purity Game (24k vs. 22k vs. 18k)

I see so many people getting confused by the “K” number. Let’s clear this up once and for all so you never get cheated.

24k Gold (99.9% Pure)

This is the raw stuff. It is beautiful, rich, and yellow. But it is soft—like, really soft. You can bend a thin 24k coin with your bare hands.

- Good for: Investment coins, bars.

- Bad for: Jewelry. If you make a ring out of 24k gold, it will lose its shape in a week.

22k Gold (91.6% Pure)

This is the gold standard for a Smart Gold Investment in jewelry. It is 91.6% gold mixed with stronger metals like copper, silver, zinc, or nickel. This mix makes the gold hard enough to hold its shape but keeps it pure enough to be valuable.

- Good for: Necklaces, bangles, chains, earrings.

- Verdict: Always stick to 22k for investment jewelry.

18k Gold (75% Pure)

This contains 75% gold and 25% other metals. It is very hard and durable.

- Good for: Diamond jewelry. Diamonds are heavy and need a strong metal grip to hold them in place. 22k is too soft for diamonds; the claws would open up, and the stone would fall out.

- Verdict: Great for fashion and diamonds, but lower resale value compared to 22k.

Rule #2: Hallmarking is Your Best Friend

If you take only one thing away from this article, let it be this: Never, ever buy gold without a BIS Hallmark.

In the old days, family jewelers would give a verbal guarantee. “Don’t worry Bhabhi ji, this is pure,” they would say. That verbal guarantee is worthless today.

The Government of India has made hallmarking mandatory for a reason. It protects you. A BIS Hallmark ensures that the gold you are buying is actually as pure as the jeweler claims.

What is HUID?

Recently, the system changed to become even more secure. Now, every piece of hallmarked jewelry has a HUID (Hallmark Unique Identification) code. It is a 6-digit alphanumeric code (like A1B 2C3) laser-etched onto the jewelry.

Think of it like the Aadhar card for your jewelry. It tracks the piece from the manufacturing center to the showroom.

Pro Tip:

Verify It Yourself! You don’t have to blindly trust the jeweler. Download the “BIS Care App” on your phone. There is a feature called “Verify HUID.” Type in the 6-digit code stamped on the jewelry. The app will instantly tell you the jeweler’s name, the purity, and the date of hallmarking. If the details don’t match, walk away!

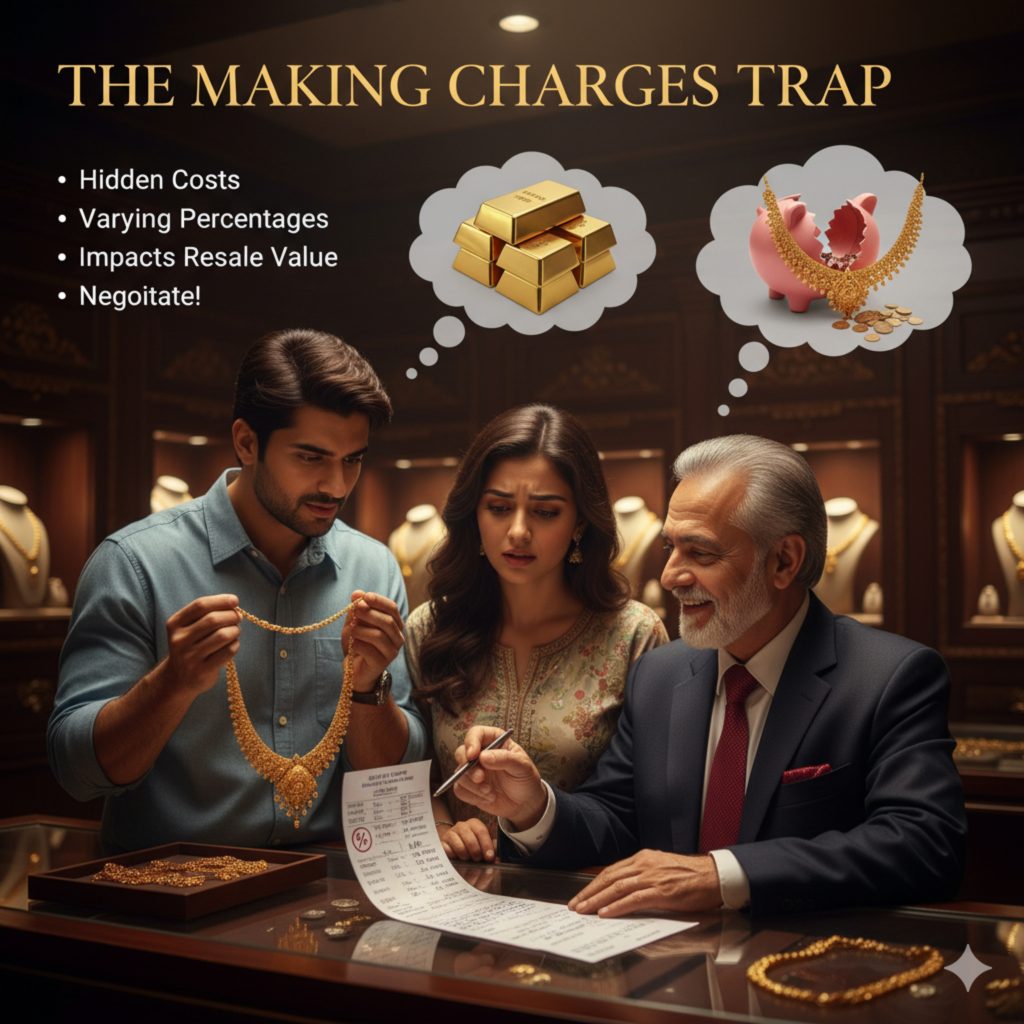

Rule #3: The “Making Charges” Trap

This is where most investors lose money.

When you buy jewelry, the price formula looks like this: Price = (Price of Gold x Weight) + Making Charges + GST (3%)

Making charges (also called majuri) are the labor costs paid to the artisan who made the jewelry. Here is the harsh truth: When you sell the jewelry, you do not get the making charges back. You only get paid for the gold.

So, if you buy a complicated, antique-design necklace with 25% making charges, your investment is already down by 25% the moment you walk out of the store. Gold prices have to rise by 25% just for you to break even!

How to Fix This?

To make a Smart Gold Investment, you need to minimize making charges.

- Machine-Made Chains/Bangles: These usually have lower making charges (around 8% to 12%) because they are mass-produced.

- Plain Designs: Intricate work costs more. Simple, elegant designs cost less.

- Avoid “Wastage”: Some jewelers add a “wastage” charge. Negotiate this. In hallmarked jewelry, wastage should be minimal.

Stones: The Enemy of ROI

I know, I know. Polki sets and Kundan necklaces look stunning. They make you feel like a queen. But strictly from an investment perspective? They are terrible.

When you buy studded jewelry:

- You pay for the weight of the gold.

- You pay a high price for the stones (often semi-precious).

- You pay very high making charges.

When you sell studded jewelry:

- The jeweler melts the gold.

- They remove the stones.

- They deduct the weight of the stones (and often deduct a bit extra for “impurities”).

- You get nothing for the semi-precious stones.

Unless you are buying certified high-grade diamonds (which have their own separate resale value), stick to plain gold. If you want the look of stones, buy gold jewelry with enamel work (Meenakari)—it adds color without adding weight that gets deducted later

Best Designs for Investment in 2025

So, what should you actually buy? You want items that are “liquid” (easy to sell) and have low making charges. Here is my shopping list for you:

1. Solid Gold Bangles

Bangles are classic. But avoid the hollow pipes filled with lac (wax). If they break or dent, they are hard to repair, and the wax weight is deducted when selling. Buy solid gold bangles or “kadas”. They are durable for daily wear and hold value perfectly.

2. The “Gold Coin” Pendant

This is a clever hack. Buy a 5g or 10g pure gold coin (low making charges). Then, buy a simple frame to turn it into a pendant. You get the investment benefits of a coin but can still wear it as jewelry!

3. Lightweight Chains

Heavy chains are out; layering is in. Lightweight chains (10g to 15g) are very easy to sell or exchange if you need quick cash. They are always in high demand.

4. Gold “Biscuits” or Coins

Okay, this isn’t jewelry, but if you have a large budget (say, for a future wedding in 5 years), don’t buy the bridal set now. Fashions change. Buy gold coins or bars now. They have near-zero making charges. When the wedding comes, exchange the coins for the latest jewelry designs. You will save a fortune on outdated fashion.

Buying Strategies: Timing and Schemes

The Monthly Gold Scheme (SIP)

Most big jewelers (like Tanishq, Kalyan, Malabar) offer monthly purchase schemes. You pay a fixed amount (say, ₹5,000) for 11 months, and in the 12th month, the jeweler pays the last installment or gives a discount on making charges.

Is it worth it? Yes, if you plan to buy jewelry anyway. The discount on making charges can be substantial. It forces you to save disciplined money. Just make sure the jeweler is reputable.

Buying on Dips

Don’t wait for Dhanteras or Akshaya Tritiya to buy. Ironically, gold prices often spike on these festival days because demand is high. Watch the market. If gold prices drop suddenly (which happens a few times a year), that is your signal to buy. Even a drop of ₹100 per gram saves you ₹1,000 on a 10-gram coin.

Caring for Your Investment

Your gold is money. Treat it with respect.

- Don’t wear it while swimming or cleaning: Chlorine and harsh chemicals can weaken the metal and discolor it.

- Store separately: Don’t throw all chains in one box. They will scratch each other. Wrap them in soft cloth or keep them in separate fabric pouches.

- Check the clasps: Every year, check the hooks and clasps of your chains. Gold is soft; hooks can open up over time, leading to loss.

Conclusion: Start Small, Start Now

You don’t need lakhs of rupees to start investing in gold. You can start with a 2-gram ring or a 4-gram pendant.

The goal of a Smart Gold Investment isn’t just to lock money away in a locker. It is to enjoy the beauty of the metal today while knowing it will take care of you tomorrow.

Remember the checklist before you pay:

- Is it 22k?

- Is the HUID stamp visible?

- Did I check the code on the BIS Care App?

- Are the making charges reasonable?

If the answer is yes, go ahead and buy that sparkle. You earned it!

I’d love to hear from you! Do you prefer buying gold coins or jewelry for investment? Tell me your thoughts in the comments below.

Frequently Asked Questions (FAQs)

Is it better to buy gold coins or jewelry?

From a pure profit view, gold coins are better because they have very low making charges (1-3%). However, jewelry serves a dual purpose: you can wear it and save money. If you want to use the gold, buy jewelry. If you want to store it for 5+ years, buy coins.

Can I sell hallmarked gold anywhere in India?

Yes! That is the beauty of the BIS Hallmark. You can buy a bangle in Kerala and sell it in Delhi. Any jeweler will recognize the hallmark and give you the current market rate for that purity.

What happens if I buy gold without a hallmark?

You are taking a big risk. If you try to sell non-hallmarked gold later, the jeweler will melt it to check purity. Often, it turns out to be of lower quality (like 18k or 20k) even if you paid for 22k, meaning you lose money.

Is 22k gold durable enough for daily wear?

Absolutely. 22k gold is the standard for Indian jewelry because the added metals (copper/silver) make it strong enough for daily use. 24k is too soft, but 22k is perfect for chains, bangles, and rings.

How much cash can I use to buy gold?

As per current Indian regulations, you can buy gold up to ₹2 lakhs in cash without providing a PAN card. For purchases above ₹2 lakhs, KYC (PAN/Aadhaar) is mandatory.